Table Of Content

Selling stocks should be straightforward because most platforms offer intuitive tools to place a sell order within seconds.

Unlike buying, which requires deeper research, selling often reflects a response to events—like price targets being met or risk levels rising.

How to Sell Stocks on Popular Trading Platforms

Selling stocks on modern platforms is usually quick and seamless, but each app or brokerage may have slightly different steps.

Here’s a step-by-step guide to help you understand the process, including real examples:

1. Log In and Access Your Portfolio

The first step is to sign in to your trading account and navigate to your list of holdings.

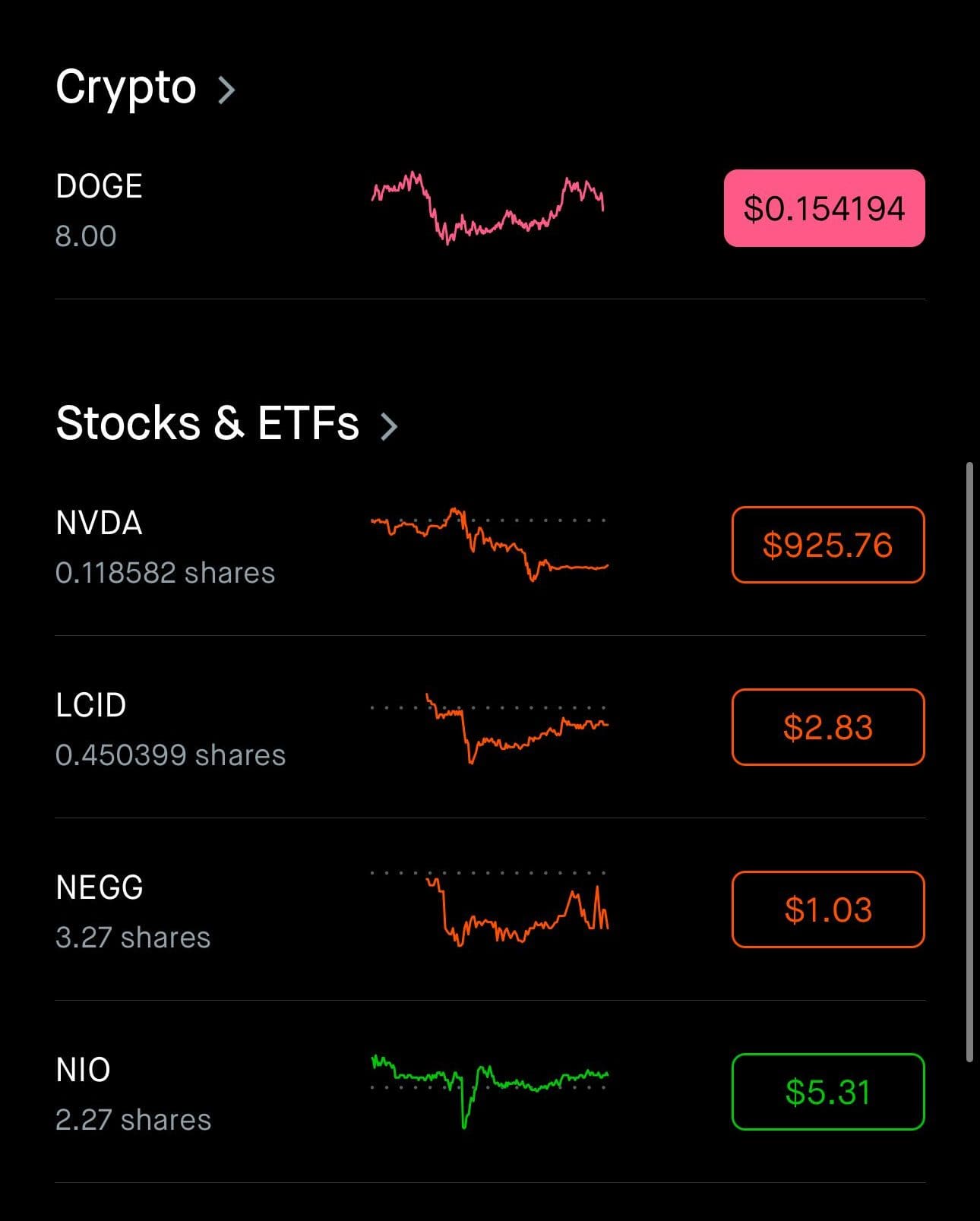

On Robinhood, for instance, you can tap the “Investing” tab to see your owned stocks.

Accessing your portfolio lets you see real-time data like current stock prices, gains or losses, and quantity owned.

2. Select the Stock You Want to Sell

Next, choose the specific stock you intend to sell. In Webull, clicking on the stock name opens a detailed view that includes performance history and analyst ratings.

Suppose you own 20 shares of Apple (AAPL) and want to sell 10 because the stock reached your price target. Clicking on Apple’s listing brings up the trading menu.

This step ensures you don’t accidentally sell the wrong security, especially if you hold similar tickers . Some platforms also provide quick charts to help you confirm your decision.

3. Initiate a Sell Order

Once you've selected the stock, locate the “Trade” or “Sell” button.

Fidelity users will find it under “Trade > Sell.” You’ll then choose how many shares to sell and the order type—market, limit, or stop-loss.

For example, if you want to sell GOOG shares only if it hits $171, you'd use a limit order. This step is crucial because the type of order determines how and when your trade is executed, especially during volatile trading hours.

4. Review the Order Before Submitting

Before confirming, double-check all the details: number of shares, order type, and estimated value. Platforms like Schwab provide an order preview page showing estimated proceeds and fees.

Imagine you're selling 50 shares of a stock at $10 each—you'll see a projected $500, minus any transaction costs.

This review step also helps you spot errors, such as accidentally selecting a market order instead of a limit order.

5. Monitor Order Status and Confirm Execution

After submission, you can track your order under the “Activity” or “Order Status” section. E*TRADE, for example, updates your order in real-time, showing whether it’s pending, filled, or canceled.

If you placed a limit order that hasn't executed yet, you might need to adjust the price or wait for market conditions to match your request.

Selling Stocks: Tips for Maximum Profit

To sell stocks for the highest possible return, you need a smart strategy—not just good timing. Here are key tips.

Use Limit Orders to Lock In Gains: Instead of selling at market price, use a limit order to set your desired price. For example, if a stock trades at $98 but you want $100, a limit order ensures you don’t settle for less.

Sell in Phases to Reduce Risk: Selling in portions—say, 50% now and 50% later—can help capture gains while staying in the game. If a stock like Nvidia continues climbing after you sell half, you’ll still benefit from future upside.

Minimize Taxes with Holding Periods: Holding stocks for over a year qualifies you for long-term capital gains tax, which is usually lower than short-term rates. For example, waiting just two more months to sell could reduce your tax bill significantly.

Watch Earnings Reports and Market Cycles: Selling before a weak earnings report or during market peaks can protect profits. Timing around key events often separates average sellers from great ones.

FAQ

Yes, many brokerages offer extended-hours trading, but prices may be less predictable due to lower trading volume and liquidity.

You may owe capital gains tax if you sell for a profit. The rate depends on how long you held the stock and your income bracket.

Funds usually settle within two business days after the sale (T+2). You can then transfer the cash or reinvest it.

Yes, but frequent same-day trading may be subject to pattern day trading rules, especially in margin accounts.

If the fundamentals have changed or you need to rebalance, selling at a loss may be wise. Tax-loss harvesting can also be a benefit.

Most modern brokerages like Robinhood and Fidelity allow you to sell fractional shares, though execution may differ slightly from whole shares.

Many platforms now offer commission-free trading, but check for any hidden fees, especially for limit or stop orders.

Selling before the ex-dividend date means you won’t receive the dividend. Consider holding through that date if income is a goal.

You can cancel a limit or stop order before it executes. Market orders usually fill instantly and can’t be reversed.